44 coupon vs interest rate

Bond yield vs coupon rate: Why is RBI trying to keep yield ... For example, if the coupon rate of a 10-year bond of face value of Rs 1,000 is 6 per cent, it will pay interest of Rs 60 every year on each bond for the investment period of 10 years. On the other... Coupon vs Yield | Top 5 Differences (with Infographics) coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

Difference Between Coupon Rate and Interest Rate | Compare ... What is the difference between Coupon Rate and Interest Rate? • Coupon Rate is the yield of a fixed income security. Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending.

Coupon vs interest rate

Interest Rates - Frequently Asked Questions | U.S ... Yields on all Treasury securities are based on actual day counts on a 365- or 366-day year basis, not a 30/360 basis, and the yield curve is based on securities that pay semiannual interest. All yield curve rates are considered "bond-equivalent" yields. Does the par yield curve assume semiannual interest payments or is it a zero-coupon curve? Coupon Vs Interest Rate Coupon Vs Interest Rate - Coupon Vs Interest Rate, Clipdeals Com Calgary, Full Mattress Set Deals, Bagittoday Coupons June 2020, Burger King Coupons Canada Pdf, Lakeshore Coupons For Free Shipping, Evans Halshaw Ford Finance Deals What is difference between coupon rate and interest rate ... The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 basis points or 0.5%. That would push up all interest rates.

Coupon vs interest rate. Bond Yield Rate vs. Coupon Rate: What's the Difference? The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its entire maturity. Prevailing interest rates may rise or... What is Coupon Rate? Definition of Coupon Rate, Coupon ... Coupon rate is not the same as the rate of interest. An example can best illustrate the difference. Suppose you bought a bond of face value Rs 1,000 and the coupon rate is 10 per cent. Every year, you'll get Rs 100 (10 per cent of Rs 1,000), which boils down to an effective rate of interest of 10 per cent. CD Rate and APY: What's the Difference? - Fox Business In today's low interest-rate environment, the difference between the APY and the nominal rate is only a few hundredths of a percentage point. Using Bankrate's tool for comparing CD rates, in mid ... What Is Coupon Rate and How Do You Calculate It? Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate on its coupon. Investors use the phrase coupon rate for two reasons. First, a bond's interest rate can often be confused for its yield rate, which we'll get to in a moment.

Coupon Rate Formula & Calculation | Coupon Rate vs ... Coupon rate refers to the fixed interest payments paid by the bond issuer and will be the same during the life of the bond. On the other hand, market interest rates might rise or fall and impact... Yield to Maturity vs. Coupon Rate: What's the Difference? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for... Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond. Bonds Bonds are fixed-income securities that are issued by corporations and governments to raise capital. The bond issuer borrows capital from the bondholder and makes fixed payments to them at a fixed (or variable) interest rate for a specified period. that includes attached coupons and pays periodic (typically ... APY vs Interest Rate: What Is the Difference [Guide for 2022] The main difference between APY and interest rate is the compounding interest. An APR or simple interest is usually distinguished in the context of borrowed money, while the APY is more commonly associated with the interest you gain when you invest money. Simple interest rates can be applied to both borrowing and investing money.

Coupon Rate vs Interest Rate | Top 6 Best Differences ... The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements. Coupon Rate vs Interest Rate | Top 8 Best Differences ... The coupon rate is decided by the issuer of the bonds to the purchaser. The interest rate is decided by the lender. Coupon rates are largely affected by the interest rates decided by the government. If the interest rates are set to 6%, then no investor will accept the bonds offering coupon rate lower than this. Coupon Rate Vs Interest - recent.shopping Coupon Rate Vs Interest, Coupon Fotoshooting Hamburg, Best Car Lease Deals In Az, Angie's List Discount Coupon, Michaels Free Coupons, Las Vegas Food Deals May 2019, Theatre Package Deals Uk recent 4.8 stars - 1974 reviews Interest Vs. Dividends: Definition, Pros & Cons Investing $1,000 in a one-year CD at a rate of 3% would yield $30 in simple interest over the term, plus your initial $1,000 investment. Not the greatest return, but it's guaranteed.

chamoisinstitute.org /difference-between-coupon-rate-and-vs-interest-rate

Coupon vs Yield | Top 8 Useful Differences (with Infographics) Let us discuss some of the major Difference Between Coupon vs Yield: The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date.

APR vs. interest rate: What are the differences? - CNET Advertised interest rates are usually reserved for borrowers with excellent credit -- traditionally defined as a score of 760 or higher -- and may also include a rate discount for setting up ...

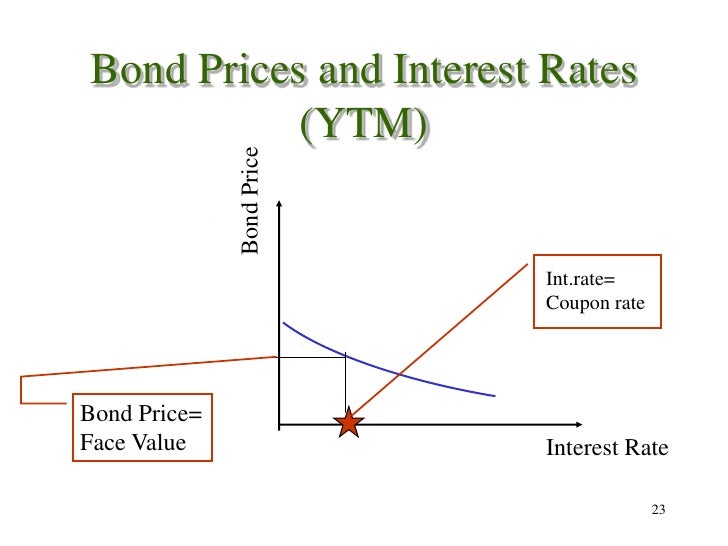

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Yield Vs. Interest Rate: Understanding the Differences ... Simple interest is calculated using the amount borrowed. So, for a $1000 loan with a 10% interest rate, the business will pay the $1000 plus $100 as interest. Compounded interest is slightly more complicated because it is calculated at the end of every period with the amount used to calculate it being the principal plus the interest amount.

Important Differences Between Coupon and Yield to Maturity Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Difference Between Coupon Rate and Required Return (With ... Difference Between Coupon Rate and Required Return (With Table) The rate of interest paid by the person who issues the bond based on the bond's face value is called the coupon rate. The periodic interest paid by the person who issues the bond to the buyer is called the coupon rate.

What's the Difference Between Premium Bonds and Discount ... A discount bond, in contrast, has a coupon rate lower than the prevailing interest rate for that bond maturity and credit quality. An example may clarify this distinction. Let's say you own an older bond—one that was originally a 10-year bond when you bought it five years ago. This bond has a 5% coupon rate and you want to sell it now.

Post a Comment for "44 coupon vs interest rate"