39 coupon rate vs ytm

Montereycounty Coupons Up To 70% Off 3% CASHBACK Use Coupon Up To 50% Off 3% CASHBACK Use Coupon Up To 50% Off 3% CASHBACK Use Coupon Most popular offers this week Free Shipping 3% CASHBACK Use Coupon Sale 3% CASHBACK Use Coupon › at › ableton45% Off Ableton Coupon Codes & Discount Codes - June 2022 20% Off Ableton Coupon Code. superbooth22 ... iShares® iBonds® 2022 Term High Yield and Income ETF | IBHB Asset Class Fixed Income. Benchmark Index Bloomberg 2022 Term High Yield and Income Index. Bloomberg Index Ticker BBG34442S. Shares Outstanding as of Jun 06, 2022 3,700,000. Distribution Frequency Monthly. Premium/Discount as of Jun 06, 2022 -0.05. CUSIP 46435U176. Closing Price as of Jun 06, 2022 23.98.

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity ... Categories > Money, Banking, & Finance > Interest Rates > Treasury Constant Maturity Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis (DGS10) 2022-06-06: 3.04 | Percent | Daily | Updated: 3:18 PM CDT

Coupon rate vs ytm

WALMART INC. Bond | Markets Insider The Walmart Inc.-Bond has a maturity date of 8/15/2037 and offers a coupon of 6.5000%. The payment of the coupon will take place 2.0 times per biannual on the 15.02.. At the current price of 129 ... Municipal Bonds Market Yields | FMSbonds.com Municipal Market Yields The tables and charts below provide yield rates for AAA, AA, and A rated municipal bonds in 10, 20 and 30 year maturity ranges. These rates reflect the approximate yield to maturity that an investor can earn in today's tax-free municipal bond market as of 05/02/2022. AAA RATED MUNI BONDS AA RATED MUNI BONDS › discount-on-bonds-payableDiscount on Bonds Payable (Definition, Example)| Journal Entries Unlike current yield, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of the term of a bond. read more (YTM). In our example, the YTM rate will be 6% p.a. It is the prevailing market interest rate on a similar trading bond. Solution:

Coupon rate vs ytm. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Bonds - Yahoo Search Results Louisiana baseball coach Matt Deggs wanted to stick with pitcher Bo Bonds with one out to get to seal the NCAA regional win over TCU Friday night at Blue Bell Park. STARBUCKS CORP.DL-NOTES 2016(16/26) Bond - Insider The Starbucks Corp.-Bond has a maturity date of 6/15/2026 and offers a coupon of 2.4500%. The payment of the coupon will take place 2.0 times per biannual on the 15.12.. At the current price of 95 ... United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 2.154% yield. 10 Years vs 2 Years bond spread is 50.2 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.00% (last modification in May 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency.

iShares Floating Rate Bond ETF | FLOT Average Yield to Maturity as of Jun 06, 2022 1.84% Weighted Avg Coupon as of Jun 06, 2022 1.27 Weighted Avg Maturity as of Jun 06, ... Securities with floating or variable interest rates may decline in value if their coupon rates do not keep pace with comparable market interest rates. The Fund's income may decline when interest rates fall ... BlackRock Ultra Short-Term Bond ETF | ICSH Average Yield to Maturity as of Jun 06, 2022 1.91% Weighted Avg Coupon as of Jun 06, 2022 1.23 Weighted Avg Maturity as of Jun 06, ... Securities with floating or variable interest rates may decline in value if their coupon rates do not keep pace with comparable market interest rates. The Fund's income may decline when interest rates fall ... › coupon-vs-yieldCoupon vs Yield | Top 5 Differences (with Infographics) The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic Let’s see the top differences between coupon vs. yield. Required Rate of Return Formula | How to Calculate RRR - Video & Lesson ... Using the CAPM formula, the required rate of return that should be demanded by investors to hold securities in company ABZ is: Required rate of return = 3% + 1.5 * (8% - 3%) = 10.5% Weighted...

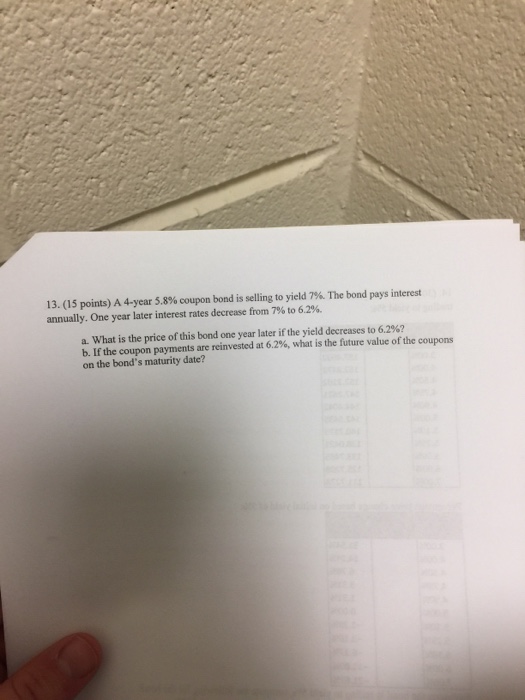

Amortised Cost and Effective Interest Rate (IFRS 9) Let's now assume that the annual coupon is reset to 6% on 1 January 20X4 following an increase in LIBOR. As mentioned earlier, for floating-rate instruments, revisions to cash flows reflecting movements in market rates of interest affect the EIR without any one-off gain/loss in P/L (IFRS 9.B5.4.5). › bond-basics-417057Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.500% yield. 10 Years vs 2 Years bond spread is 93.8 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.40% (last modification in May 2022). The India credit rating is BBB-, according to Standard & Poor's agency. canadian bond calculator international journal of applied sciences and innovation; dr horton corporate office complaints; jeff lewis live guest today; lg oven blue enamel chipping

Current Rates | Edward Jones 3.25%. $5,000,000 to $9,999,999. 3.00%. $10,000,000 and over. 2.75%. Rates effective as of March 16, 2020 . The margin interest rate is variable and is established based on the higher of a base rate of 4.00% or the current prime rate.

BHARAT Bond ETF - April 2023 - Moneycontrol Get latest NAV, Returns, SIP Returns, Performance, Ranks, Dividends, Portfolio, CRISIL Rank, Expert Recommendations, and Comparison with gold, stock,ULIP etc. Calculate SIP, VIP Returns. Now ...

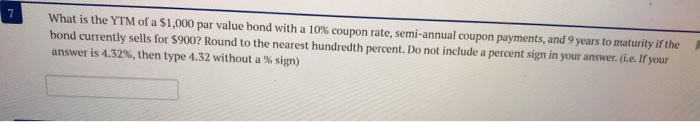

corporatefinanceinstitute.com › resourcesEquity vs Fixed Income - A Side by Side Comparison Feb 04, 2022 · The yield-to-maturity (YTM), is the single discount rate that matches the present value of the bond’s cash flows to the bond’s price. YTM is best used as an alternative way to quote a bond’s price. For a bond with annual coupon rate c% and T years to maturity, the YTM (y) is given by:

United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.988% yield. 10 Years vs 2 Years bond spread is 24.7 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.00% (last modification in May 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

› knowledge › current-yieldCurrent Yield: Bond Formula and Calculator [Excel Template] Current Yield vs Yield-to-Maturity (YTM) The yield-to-maturity (YTM) is the annualized return expected to be earned on a bond, assuming that the bond is held until the date of maturity. Moreover, YTM is the internal rate of return ( IRR ) on the bond and is widely considered a far more useful measure for comparisons among different bonds.

Preferred Stock - YTC Calculator Calculate Yield to Call : Click the Year to select the Call Date, enter coupon call and latest price then Calculate

Japan Government Bonds - Yields Curve The Japan 10Y Government Bond has a 0.244% yield. 10 Years vs 2 Years bond spread is 29.8 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is -0.10% (last modification in January 2016). The Japan credit rating is A+, according to Standard & Poor's agency.

91 Day T Bill Treasury Rate - Bankrate Year ago. 91-day T-bill auction avg disc rate. 0.90. 0.86. 0.02. What it means: The U.S. government issues short-term debt at a discount at a competitive auction, usually on a weekly basis. At a ...

SES Successfully Prices EUR 750 million Eurobond The new notes will bear a coupon of 3.50% and were priced at 99.725% of their nominal value, representing a credit spread of 175bps and a yield-to-maturity of 3.55%. ... unsecured fixed rate notes ...

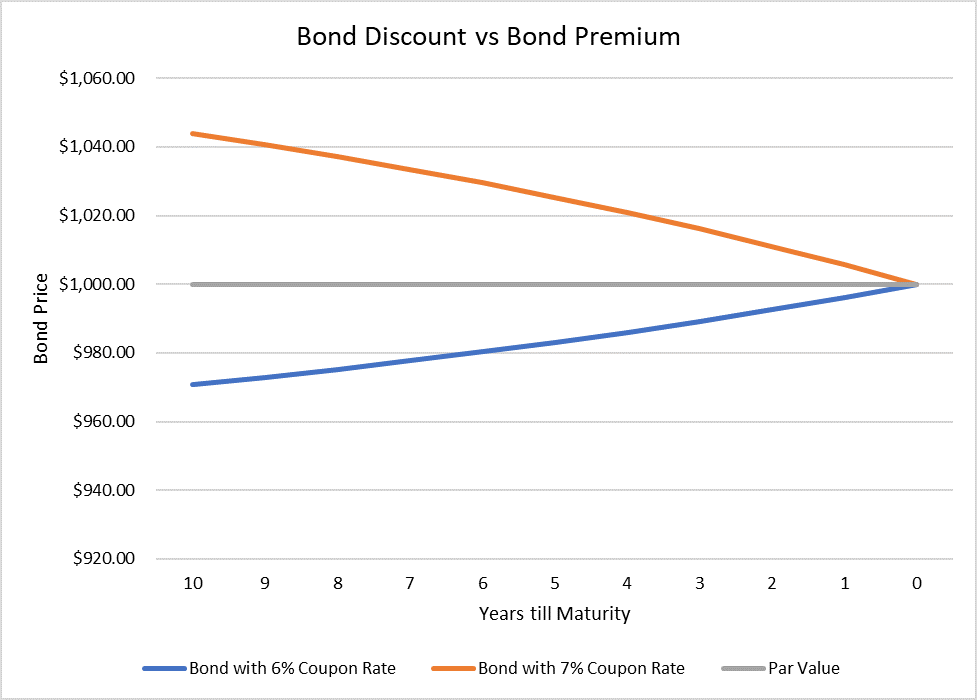

› premium-vs-discount-bonds-417066New Investor's Guide to Premium and Discount Bonds Oct 31, 2021 · A bond trades at a premium when its coupon rate is higher than the prevailing interest rates. A bond trades at a discount when its coupon rate is lower than the prevailing interest rates. Using the previous example of a bond with a par value of $1,000, the bond's price would need to fall to $750 to yield 4%, while at par, it yields 3%.

COCA-COLA CO., THEDL-NOTES 2017(17/27) Bond - Insider The The Coca-Cola Co.-Bond has a maturity date of 5/25/2027 and offers a coupon of 2.9000%. The payment of the coupon will take place 2.0 times per biannual on the 25.11..

iShares 0-5 Year TIPS Bond ETF | STIP - BlackRock Asset Class Fixed Income. Benchmark Index Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 0-5 Years Index (Series-L) Bloomberg Index Ticker LTP5TRUU. Shares Outstanding as of Jun 06, 2022 121,600,000. Distribution Frequency Monthly. Premium/Discount as of Jun 06, 2022 0.12. CUSIP 46429B747. Closing Price as of Jun 06, 2022 102.86.

Yield To Maturity 2022 - Comparebrokers.co The more you pay for a security, the higher the YTM. In contrast, a bond's yield to maturity is determined by assuming that all of its coupon payments will be reinvested at the same rate. The yield to maturity, on the other hand, takes into account the time value of money as well as the present value of future coupon payments.

Colombia Government Bonds - Yields Curve The Colombia 10Y Government Bond has a 10.660% yield. 10 Years vs 2 Years bond spread is 119 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 6.00% (last modification in April 2022). The Colombia credit rating is BB+, according to Standard & Poor's agency.

10-Year T-Note Overview - CME Group Specs. Margins. Calendar. Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis ...

› discount-on-bonds-payableDiscount on Bonds Payable (Definition, Example)| Journal Entries Unlike current yield, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of the term of a bond. read more (YTM). In our example, the YTM rate will be 6% p.a. It is the prevailing market interest rate on a similar trading bond. Solution:

Post a Comment for "39 coupon rate vs ytm"