42 ytm zero coupon bond

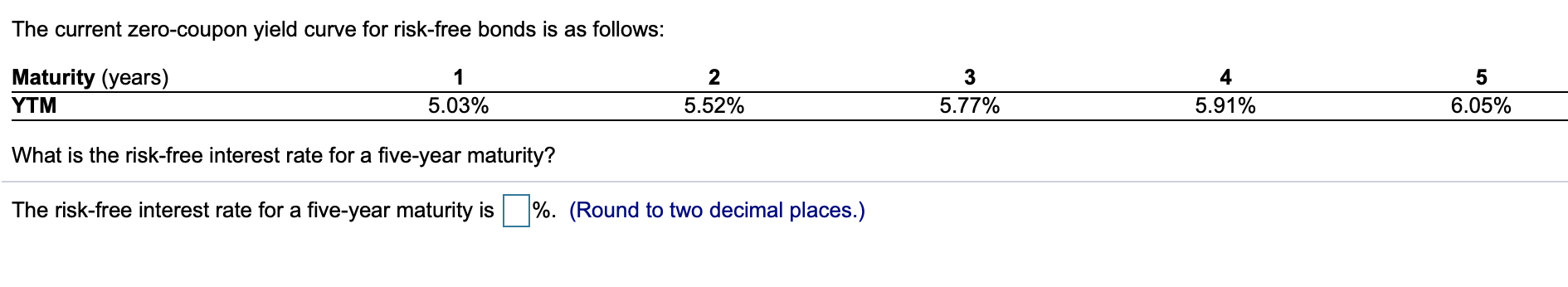

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. The prevailing ...

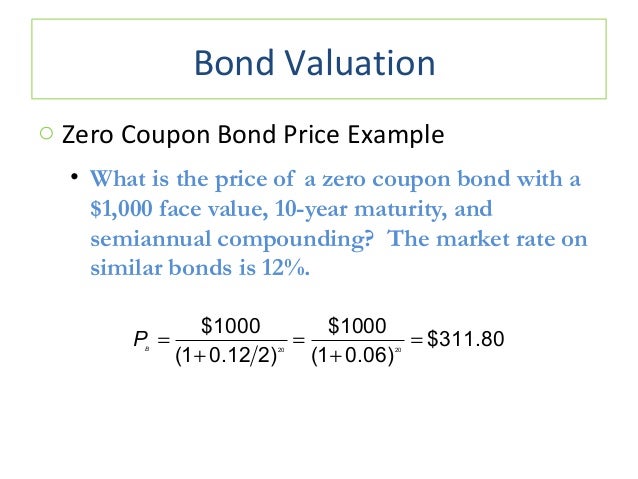

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

Ytm zero coupon bond

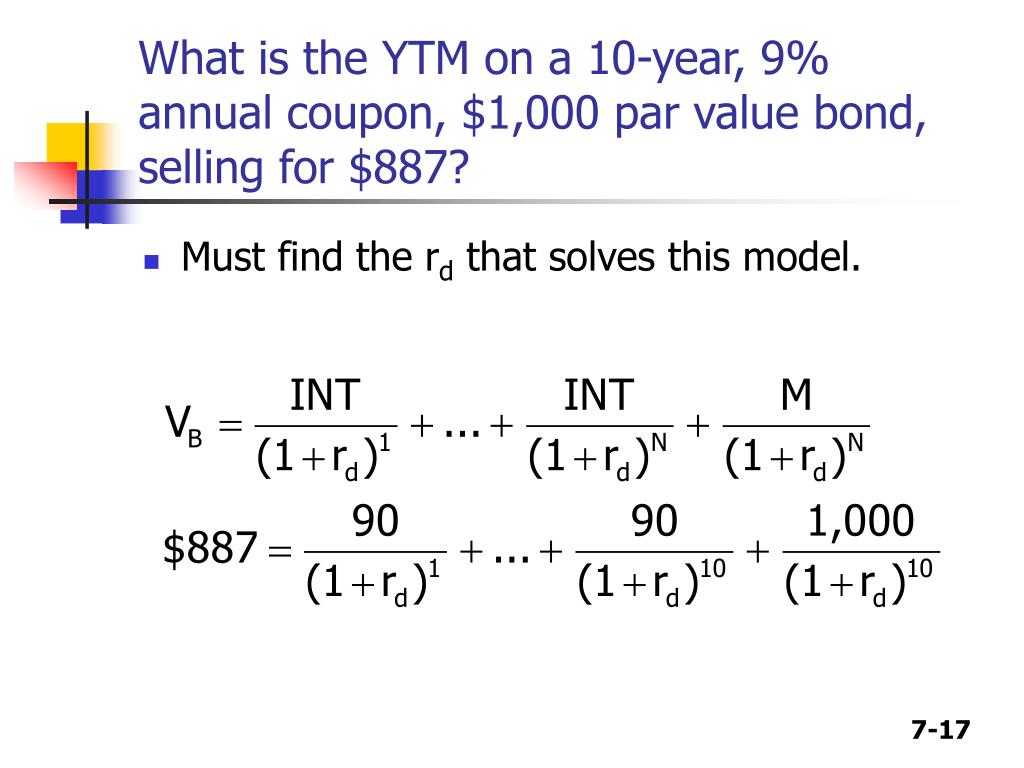

Current Yield vs. Yield to Maturity - Investopedia 13/12/2021 · For example, a bond with a $1,000 par value and a 7% coupon rate pays $70 in interest annually. Current Yield of Bonds The current yield of a bond is calculated by dividing the annual coupon ... Yield to Worst (YTW): Formula and Bond Excel Calculator Coupon Rate: 6%. Annual Coupon: $60. Now, we'll enter our assumptions into the Excel formula from earlier to calculate the yield to maturity (YTM): Yield to Maturity (YTM): "= YIELD (12/31/2021, 12/31/2031, 6%, Bond Quote, 100, 1)". By contrast, the YTC switches the "maturity" to the first call date and "redemption" to the call ... Yield to Maturity Calculator (YTM Calculator) - YTM Formula C = Bond Coupon Rate F = Bond Par Value P = Current Bond Price n = Years to Maturity. How to Calculate Yield to Maturity . To apply the yield to maturity formula, we need to define the face value, bond price and years to maturity. For example, if you purchased a $1,000 for $900. The interest is 8 percent, and it will mature in 12 years, we will plugin the variables. C = …

Ytm zero coupon bond. Yield to maturity - Wikipedia If a bond's coupon rate is more than its YTM, then the bond is selling at a premium. If a bond's coupon rate is equal to its YTM, ... Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds. For bonds with multiple coupons, it is not generally possible to solve for yield in terms … Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity CH-6 Bonds Valuation.pptx - CHAPTER 6 Bonds Valuation 1... ― Indeed, the YTM is the rate of return of investing in a bond. 6 Risk-Free Interest Rates Because a default-free zero-coupon bond that matures on date n provides a risk-free return over that period, the Law of One Price guarantees that the risk-free interest rate equals the YTM on such a bond ─ We often refer to this YTM as the risk-free ... Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · What is a Zero-Coupon Bond? A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest.

The Zero Coupon Bond: Pricing and Charactertistics A zero coupon bond is a fixed income security that is created from the cash flows that make up a normal bond. ... The profit is created by the way the "Yield to Maturity" (YTM) of a bond is calculated. The YTM of a normal bond is the same for all the bond's cash flows. On the other hand, each strip bond is valued using the YTM of a ... The yield to maturity (YTM) on a 1-year zero-coupon | Chegg.com Finance questions and answers. The yield to maturity (YTM) on a 1-year zero-coupon bond is 5.2%, the YTM on a 2-year zero bond is 5.9%, and the YTM on a 3-year zero is 6.2%. The YTM on a 3-year maturity coupon bond with coupon rates of 11.5% (paid annually) is 6%. [Assume a face value of $1,000.] How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. Ytm Of A Zero Coupon Bond Formula Initially established as a fruit and vegetables stand, Fairway Market grew into a trusted neighborhood store and eventually into a full service supermarket ytm of a zero coupon bond formula that now stocks an array of conventional groceries and harder to find. Check our weekly circular to get the best deals and prices out there.

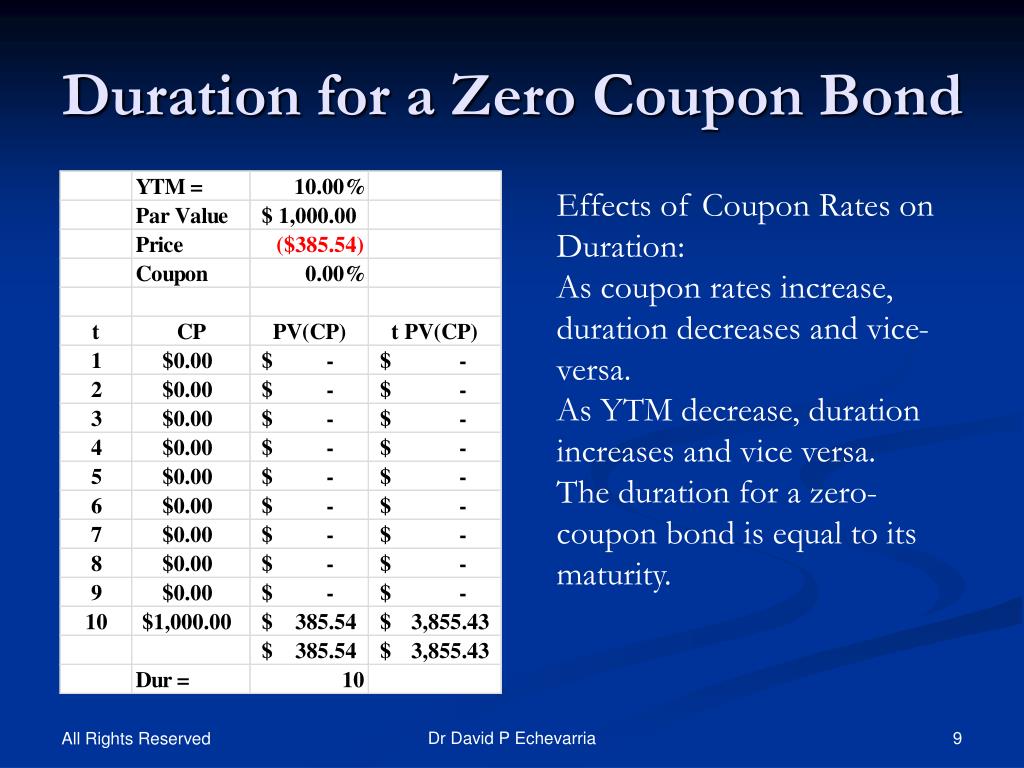

Bond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: Yield to Maturity (YTM) Definition - Investopedia 11/11/2021 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , … How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Yield to Maturity (YTM): Formula and Excel Calculator What is the Yield to Maturity (YTM)? The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity. From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made …

Zero Coupon Bond Calculator 【Yield & Formula】 The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

The yield to maturity (YTM) on zero-coupon 10-year - Chegg The yield to maturity (YTM) on zero-coupon 10-year corporate bond depends on the risk-free 1-year spot rate r and a risk parameter x according to the following formula: YTM=r+x+30rx. The YTM is expressed as annual rate with semi-annual compounding. Assume the face value of the bond is $10,000. a) Find the bond price if r=0.08 (i.e., 6%) and x=0.02

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder.

CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL | Dr ... - YouTube In this lecture I am explaining how to #TYM#YieldToMaturity#HOW_TO_CALCULATE_YIELD_ON_ZERO_COUPON_BOND #YTM_IN_EXCEL calculate the yield on zero COUPON bond ...

Zero Coupon Bonds - Financial Edge Training Oct 8, 2020 — Zero coupon bonds are different since they do not pay investors any interest payments between issuance and maturity. Instead, they offer ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. This makes typical bonds a great source of …

Bond Yield to Maturity (YTM) Calculator - DQYDJ You can compare YTM between various debt issues to see which ones would perform best. Note the caveat that YTM though – these calculations assume no missed or delayed payments and reinvesting at the same rate upon coupon payments. For other calculators in our financial basics series, please see: Zero Coupon Bond Calculator

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... P = M / (1+r)n variable definitions: 1. P = price 2. M = maturity value 3. r = annual yield divided by 2 4. n = years until maturity times 2 The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price o...

Answered: A zero coupon bond has a par value of… | bartleby A zero coupon bond has a par value of $10,000 and a current price of $5,500. If the bond has 7 years to maturity, what is its after-tax yield to maturity for an investor paying 25% taxes? Use semiannual analysis. (Enter answer as a percentage to two decimals with no % sign)

Yield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Solved If the YTM on a 2 year zero coupon bond that starts - Chegg If the YTM on a 2 year zero coupon bond that starts today is 5% and the YTM on a 1 year zero coupon bond that starts today is 3%. What does the no-arbitrage condition tell you about the interest rate on a one year bond that starts next year? Its (1.05/1.03) - 1 = 2% = It's 5%-3% = 2% = O It's ((1.05)^2 / 1.03) -1 = 7% O It's the average of 3% ...

Zero Coupon Bond Yield Calculator - YTM of a discount bond A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond.

_.jpg)

Post a Comment for "42 ytm zero coupon bond"