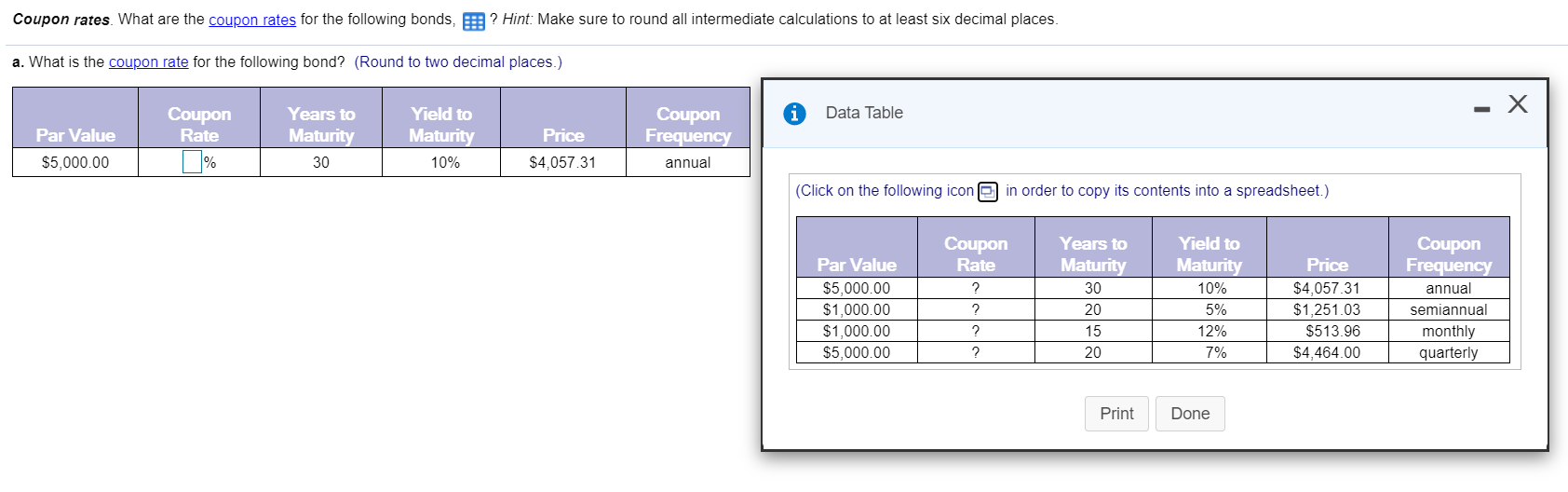

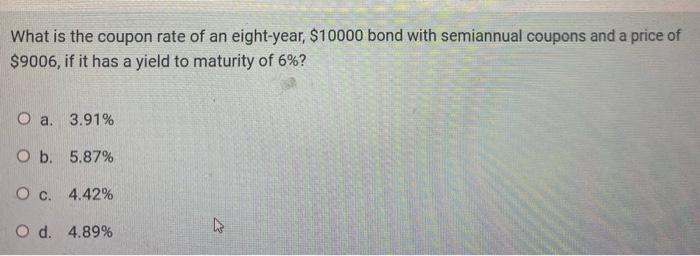

43 what is the coupon rate

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value . Coupon Codes & Discount Deals UAE. Free Vouchers ... Nov 21, 2022 · Extra 20% OFF Everthing Sitewide: FUN80 Level Shoes Coupon Code: 10% Off Everything Eromman Coupon Code: Get 5% Off On Everything Sitewide Get Up to 80% Off + Extra 30% Off On Everything via H&M Discount Code Get Up to 90% Off On Footwear, Accessories & Bags + 5% Off Discounted Items Enjoy Up to 90% Off Deals + Get Extra Up to 30% OFF On Everything

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

What is the coupon rate

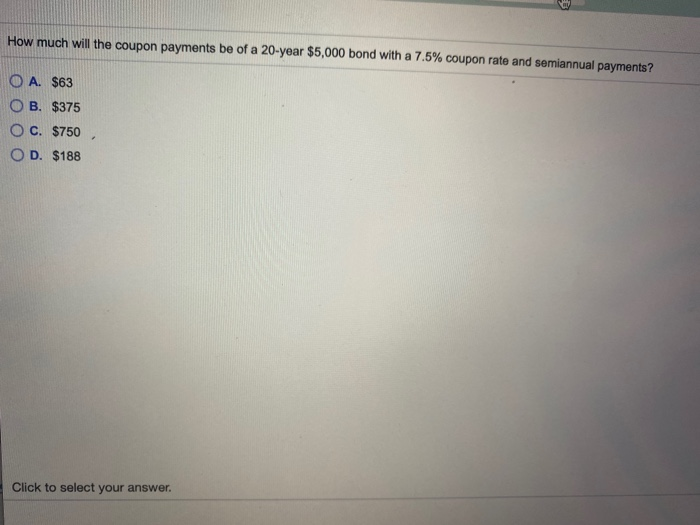

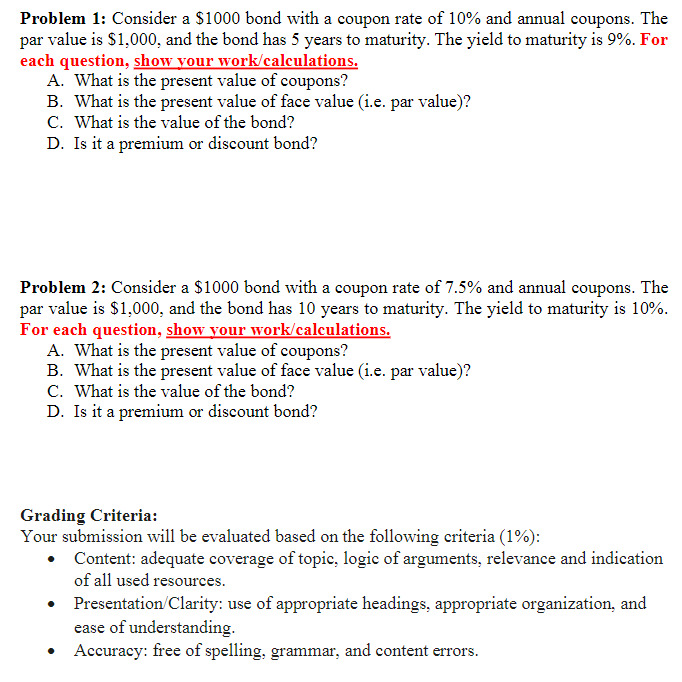

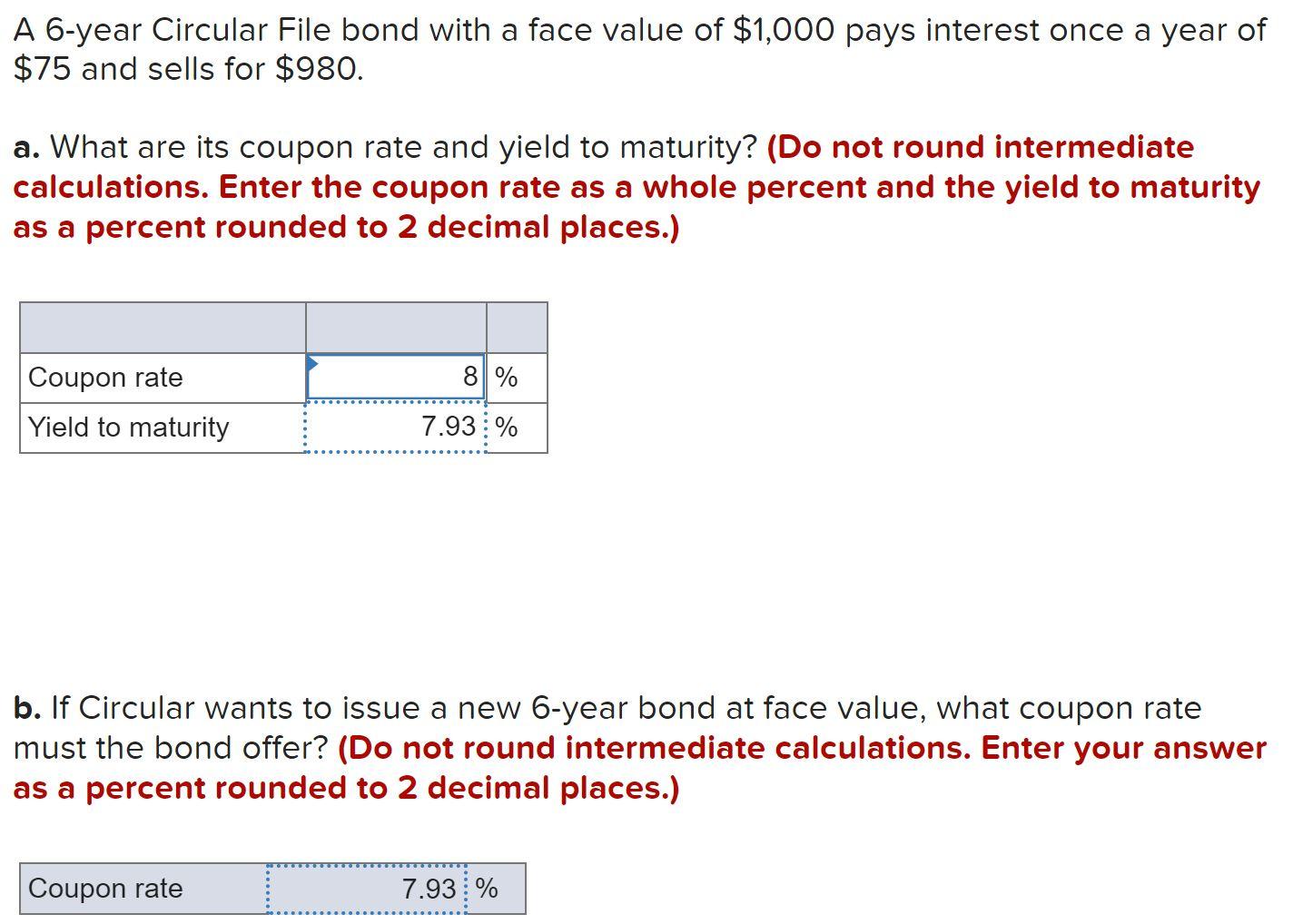

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. For example, if an investor pays less ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

What is the coupon rate. Coupon Rate | Definition | Finance Strategists Coupon Rate Definition. A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer. What Is a Coupon Rate? - Investment Firms Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. For instance, say a bond has face value of $2000 and a coupon rate of 10%. Therefore, it pays $200 every year no matter what ... What is a Coupon Rate? | Bond Investing | Investment U Coupon rates play a significant role in dictating demand for certain bonds. They come fixed at the time of issuance, while interest rates change. This means the two work in tandem to drive bond prices—and thus, demand for bonds. If the rate is higher than the current interest rate, bonds will trade at a premium. Coupon Equivalent Rate (CER) Definition - Investopedia Coupon Equivalent Rate - CER: A alternative calculation of coupon rate used to compare zero-coupon and coupon fixed-income securities. Formula:

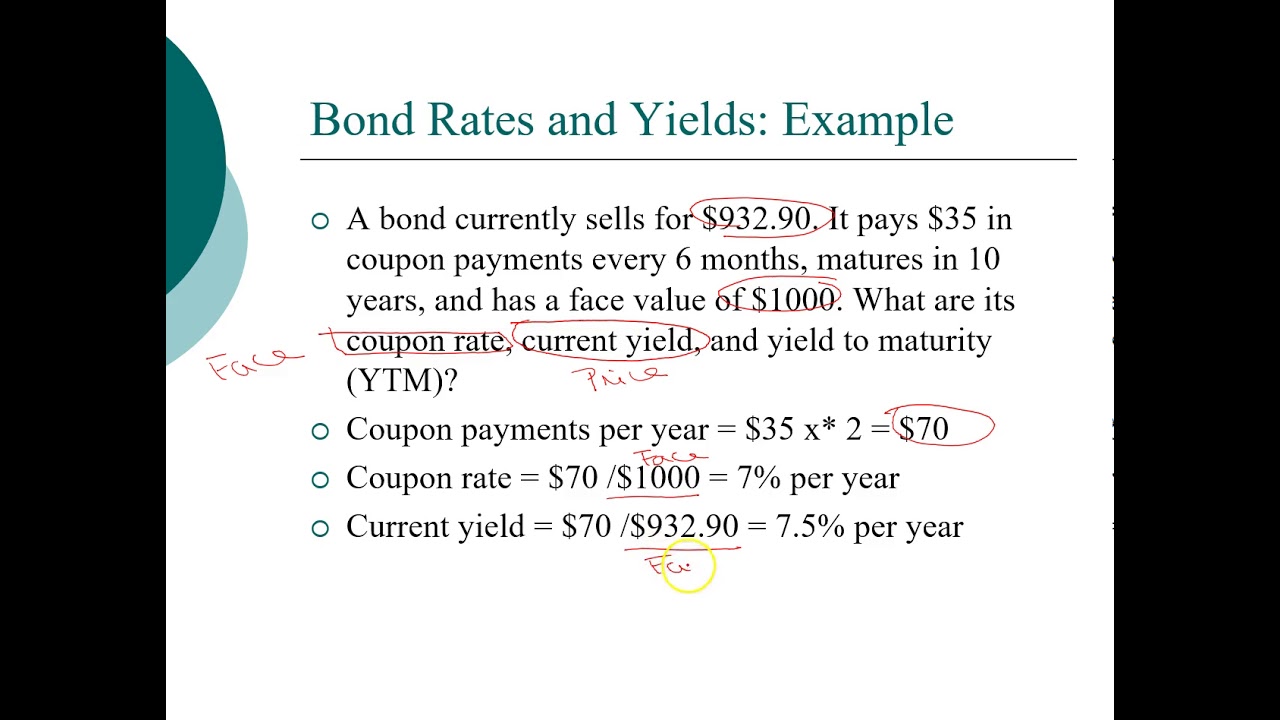

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ... What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. Instead of periodic interest payments based on the coupon rate, the higher face value is ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The coupon rate is the annual income an investor can expect to receive while holding a particular bond. At the time it is purchased, a bond's yield to maturity and its coupon rate are the same.

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ... Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... HPR for bonds with lower coupon rates vs higher coupon rates? For an assignment, we had to calculate the holding period return of two bonds with a 9% and 6% coupon rate (c, photo below). Unsurprisingly, the HPR was higher for both when YTM decreases, but I was surprised to notice that the bond with the lower coupon rate has a higher HPR. Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon rate is the interest the bond issuer pays to the bondholder on an annual basis. In other words, it is the return an investor can expect from their bond investment. This article explains the coupon rate for bonds, its calculation, importance and difference between coupon rate and yield to maturity in detail.

What is a Coupon Rate? - Definition | Meaning | Example In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80. So, Georgia will receive $80 interest payment as a bondholder.

What is NCD coupon rate? - help.indiainfoline.com What is NCD coupon rate? Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. Updated: 12 hours ago.

What is coupon rate | Definition and Meaning | Capital.com A coupon rate is a yield that is paid out for a fixed-income security such as a government and corporate bond. A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. The coupon payment on a bond is the interest payment received by the holder of the bond ...

What Is the Coupon Rate of a Bond? - The Balance The coupon rate on a bond or other fixed income security is the stated interest rate based on the face or par value of the bond. The bond's yield is the dollar value of the annual interest payments as a percentage of the bond's current price. Investors can use a bond's coupon rate to benchmark the level of interest they will receive ...

What Is Coupon Rate and How Do You Calculate It? A bond's coupon price could be calculated by dividing the sum of the safety's annual coupon payments and dividing them by the bond's par worth. For instance, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with larger coupon rates are extra desirable for ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate. In our example above, the $1,000 pays a 10% interest rate. Investors use the phrase “coupon rate” for two reasons.

What is yield to maturity? | Difference between YTM and coupon rate ... With financial literacy becoming more widespread, the bond market has become a good investment alternative. The returns received on bond investment are quite...

What Is a Bond Coupon, and How Is It Calculated? - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. For example, if an investor pays less ...

Post a Comment for "43 what is the coupon rate"