44 a 10 year bond with a 9 annual coupon

A 10-year bond with a 9% annual coupon has a yield to maturity of 8% ... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling below its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d. Finance Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. The bond's current yield is greater than 9%. c.

A 10 year bond with a 9 annual coupon has a yield to See Page 1. 43. A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value.c. The bond is selling at a discount.

A 10 year bond with a 9 annual coupon

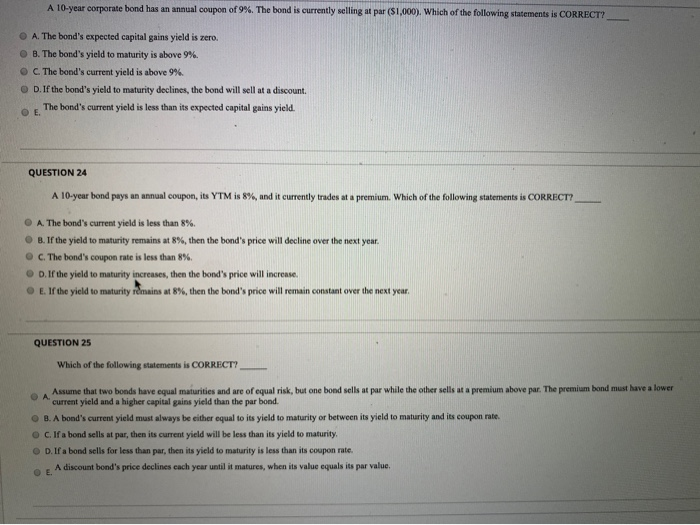

FINN 3226 CH. 4 Flashcards | Quizlet The bond's coupon rate is less than 8%. A A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. A 10 year corporate bond has an annual coupon of 9 A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is INCORRECT? a. The bond's expected capital gains yield is positive. b. The bond's yield to maturity is 9%. c. The bond's current yield is 9%. d. The bond's current yield exceeds its capital gains yield. ANS: A a. A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year corporate bond has an annual coupon of 9%. The 3. A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is … read more JKCPA CPA Bachelor's Degree 844 satisfied customers 5. If a bank loan officer were considering a companys request 5.

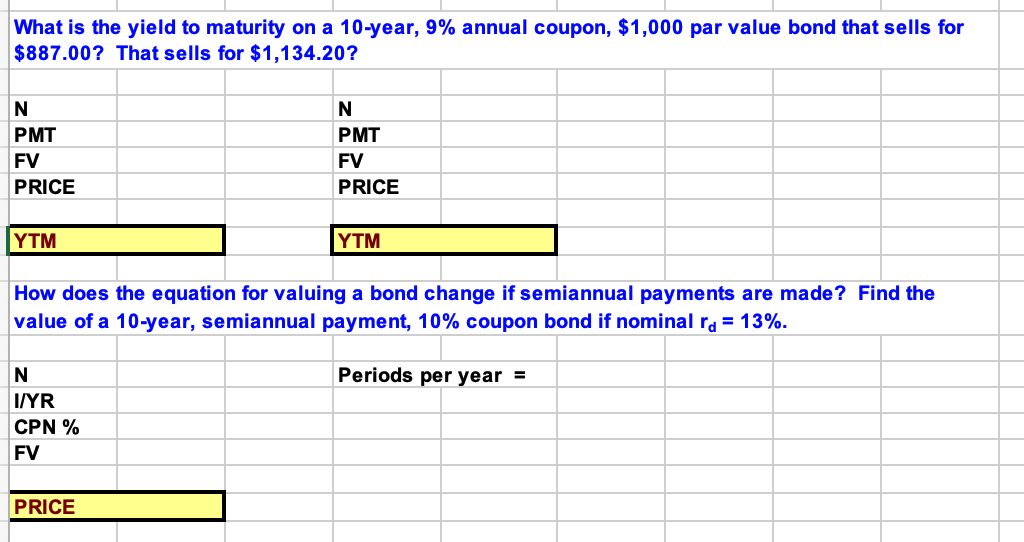

A 10 year bond with a 9 annual coupon. Answered: A 10-year bond with a 9% annual coupon… | bartleby Business Finance Q&A Library A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%. A 10-year corporate bond has an annual coupon of 9%. the bond is ... Tamang sagot sa tanong: A 10-year corporate bond has an annual coupon of 9%. the bond is currently selling at par ($1,000). which of the following statements is correct Solved 1) A 10-year bond with a 9% annual coupon has a yield - Chegg Question: 1) A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling at a premium to par value. b. The bond is selling at a discount. c. The bond is selling below its par value. d. The bond will earn a rate of return greater than 8%. This problem has been solved! Answered: uppose you bought a 10 percent coupon… | bartleby Transcribed Image Text: 8.2 Suppose you bought a 10 percent coupon bond one year ago for $1,150. The bond sells for $1,080 today. a. 1 Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your rate of return on this investment over the past year? (this will be a nominal rate of ...

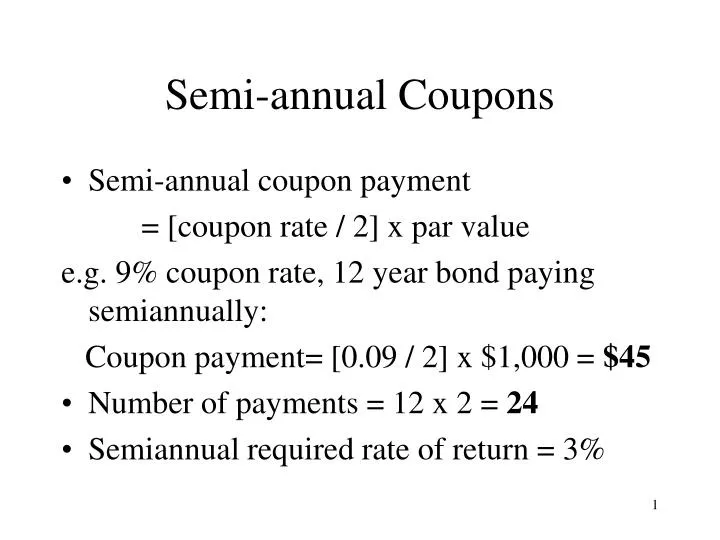

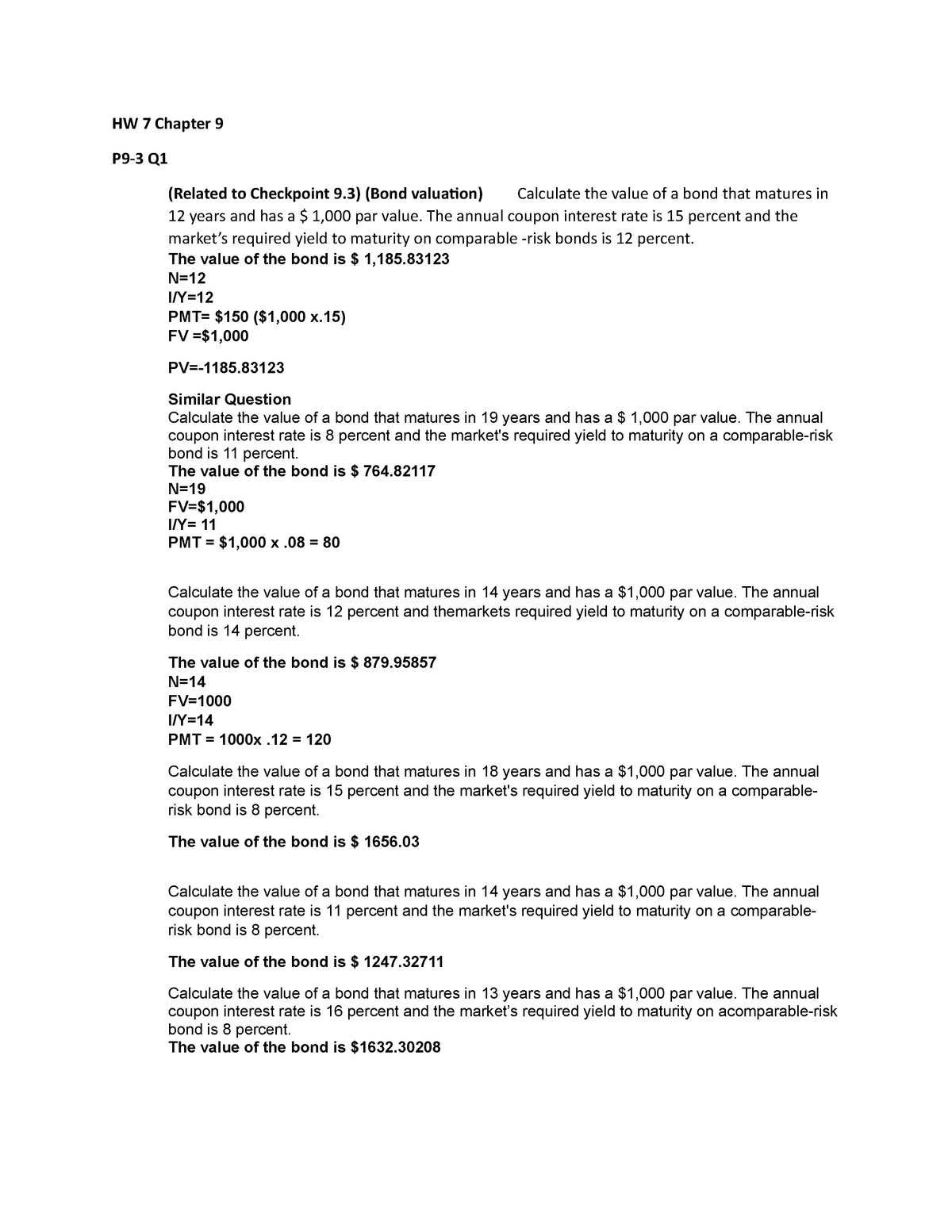

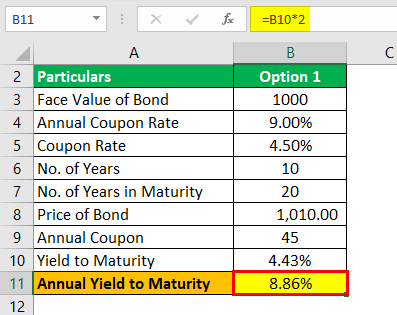

What is the price of a two year bond with a 9% annual coupon and a ... Annual coupon = 0.09 * 1,000 = $90 Yield to maturity = 8% Formula to Calculate Bond Price The formula for bond pricing is basically the calculation of the present value of the probable future cash flows, which comprises of the coupon payments and the par value, which is the redemption amount on maturity. [Solved] A bond that matures in 10 years has a 1000 par value The ... Step1 - Calculation for Annual payment of interest A n n u a l I n t e r e s t = F a c e v a l u e × R a t e o f i n t e r e s t = $ 1, 000 × 9 % = $ 90 Step2 - Calculation for value of annual paying bond Value of bonds can be calculated by using 'PV' formula of spreadsheet or Excel The formula is shown below Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. If the yield to maturity remains constant, the bond's price one year from now will be higher than its

A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year corporate bond has an annual coupon of 9%. The 3. A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is … read more JKCPA CPA Bachelor's Degree 844 satisfied customers 5. If a bank loan officer were considering a companys request 5. A 10 year corporate bond has an annual coupon of 9 A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is INCORRECT? a. The bond's expected capital gains yield is positive. b. The bond's yield to maturity is 9%. c. The bond's current yield is 9%. d. The bond's current yield exceeds its capital gains yield. ANS: A a. FINN 3226 CH. 4 Flashcards | Quizlet The bond's coupon rate is less than 8%. A A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b.

Post a Comment for "44 a 10 year bond with a 9 annual coupon"